Poised and ready for new investments

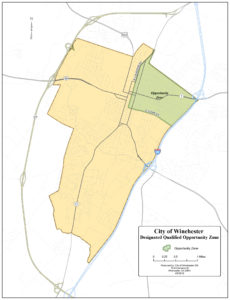

With its 793-acre Opportunity Zone, the City of Winchester, Virginia, is poised for new investment. Our Opportunity Zone – located in the northwest corner of the city – is home to a handful of sites and buildings just waiting to be developed. Businesses that locate within our Opportunity Zone may be eligible for preferential tax treatment based on development and job creation in the neighborhood.

Below are a few of our Opportunity Zone properties. Click on the plus sign for more information.

Winchester Opportunities

Berryville Avenue Corridor

A key tourist entry corridor into the city, Berryville Avenue spans one mile along Route 7 leading into the core historic district of downtown Winchester. Located within a corridor enhancement district, Berryville Avenue is zoned B2 to encourage commercial development.

A key tourist entry corridor into the city, Berryville Avenue spans one mile along Route 7 leading into the core historic district of downtown Winchester. Located within a corridor enhancement district, Berryville Avenue is zoned B2 to encourage commercial development.

About Opportunity Zones

Opportunity Zones are designed to spur economic development by providing tax benefits to investors. Investors can defer tax on any prior gains invested in a Qualified Opportunity Fund (QOF) until the earlier of the date on which the investment in a QOF is sold or exchanged, or December 31, 2026. If the QOF investment is held for longer than 5 years, there is a 10% exclusion of the deferred gain. If held for more than 7 years, the 10% becomes 15%. If the investor holds the investment in the Opportunity Fund for at least ten years, the investor is eligible for an increase in basis of the QOF investment equal to its fair market value on the date that the QOF investment is sold or exchanged.

A Qualified Opportunity Fund is an investment vehicle that is set up as either a partnership or corporation for investing in eligible property that is located in a Qualified Opportunity Zone and utilizes the investor’s gains from a from a prior investment for funding the OF. There are three types of properties eligible for OZ investment:

- Stock of a qualified OZ corporation

- Partnership Interest in a qualified OZ partnership

- Business property used in a qualified OZ, tangible property used in trade or business

Investments that do not qualify include funds of “sin” businesses, and financial institutions.

Click here to learn more about Virginia Opportunity Zones.